Provisions of Key Interest to U.S. Expatriates

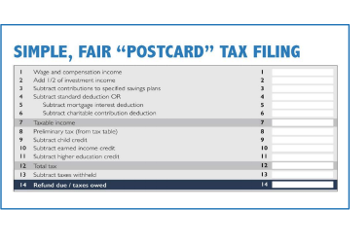

The Ways and Means Committee has published details of the Tax Cuts and Jobs Act (H.R. 1) that is scheduled for markup beginning November 6, 2017. There are likely to be changes as it makes its way through the Congress and the exact impacts may only be known once the legislation is finalized, notwithstanding the political hurdles that need to be overcome. The tax plan will clearly not create the kind of “postcard” tax return touted by the GOP but is being promoted as a first attempt to simplify a complicated tax code and make it fairer to all. While the Congress deliberates on the legislation, we take a first look at the GOP tax plan and highlight some provisions that may be of key interest to U.S. expatriates. Expatriates who are concerned about the potential tax implications of the proposed changes should consult their tax advisors and consider accelerating or postponing certain transactions based on their personal circumstances.

Consolidation from 7 to 4 Tax Brackets:

There has been much debate about the progressive tax system in existence. With the proposal to reduce the number of tax brackets from 7 to 4 and index the income levels of these brackets for chained CPI, the question is how the changes in tax rates and the width of each bracket could affect your liabilities. Summarized below are a comparison of the tax brackets, the estimated tax impacts, and our initial observations –

- Taxpayers in the current 33% brackets will generally see smaller tax savings than those in the lower brackets because substantial portions of the 33% brackets will be incorporated into the proposed 35% brackets. This is especially marked for Single taxpayers due primarily to the reassignment of thresholds.

- Married taxpayers with high income within the proposed 35% brackets (up to $1,000,000 for MFJ and $500,000 for MFS) may stand to gain the most from these changes, without which, approximately 71.5% of the income within this proposed bracket would have been subject to tax at 39.6%.

- Taxpayers whose adjusted gross income is in excess of $1 million ($1.2 million for MFJ) will not fully benefit from the 12% bracket. The tax benefit of the 12% bracket will be subject to phaseout at 6%.

Maximum Capital Gains Rate:

Maximum rates for long-term capital gains and qualified dividends would be realigned with the new tax rates. It appears, however, that the thresholds are misstated in the tax bill.

Repeal of Alternative Minimum Tax:

The Alternative Minimum Tax (AMT), a complex alternative tax system originally designed to ensure wealthy taxpayers who may otherwise exploit various deductions would pay a minimum amount of income tax but has since affected about 4.5 million families, would be repealed. If a taxpayer has AMT credit carryforwards, the taxpayer would be able to claim a refund of 50% of the remaining credits (to the extent the credits exceed regular tax for the year) in tax years beginning in 2019, 2020, and 2021. Taxpayers would be able to claim a refund of all remaining credits in the tax year beginning in 2022.

The exercise of incentive stock options (ISO) has been one of the most common reasons why expatriates were subject to AMT, having to recognize income, usually before any is realized, and pay AMT. This should no longer be relevant after the repeal.

Expatriates who had paid AMT on “preference items,” such as ISO, which cause merely timing difference in income recognition, should continue to keep track of their AMT for the purpose of claiming Minimum Tax Credit (MTC).

Maximum Tax Rate on Business Income of Individuals:

Only Business Income Related to Capital Eligible – Presumed 30% Attributable to Capital and 70% to Labor

Consistent with the tax reform framework drawn up by the “Big Six” in late September, the maximum tax rate for business income of small and family-owned businesses conducted as sole proprietorships, partnerships and S-corporations would be limited to 25%. Since the objective of this provision is to provide a tax concession for return on capital investments but to prevent wealthy taxpayers from avoiding higher tax rates by recharacterizing their personal income, clear distinctions are made between labor and capital share of business income –

- Certain personal services businesses (e.g., businesses involving the performance of services in the fields of law, accounting, consulting, engineering, financial services, or performing arts) would not be eligible for the 25% rate.

- 100% of the “net business income” derived from passive business activities would be eligible for the 25% rate.

- Generally, 30% of the “net business income” derived from active business activities, representing a return on capital, would be eligible for the 25% rate unless a binding 5-year election is made to apply a higher capital percentage as determined by a formula.

- As an anti-avoidance provision, the capital percentage would be limited if actual wages or income treated as received in exchange for services (e.g. a guaranteed payment) exceeds the taxpayer’s otherwise applicable capital percentage.

Investment Income Subject to Separate Taxation

“Net business income” would also exclude certain types of income derived from such business activities, which would retain their respective characters and be subject to tax separately.

- Net long-term capital gains and qualified dividend income would remain taxable at preferential capital gain tax rates.

- Certain other investment income such as short-term capital gains, dividends, and foreign currency gains not related to the business needs would remain taxable as ordinary income at the taxpayer’s marginal rates.

Effect on Self-Employment Tax

The converse of capital percentage is labor percentage. Assuming the capital percentage is 30%, the remaining 70% would be labor percentage. Labor percentage would be applied against gross income and deductions of the taxpayer’s trade or business as well as distributive share of income and loss from partnerships to compute net earnings subject to self-employment tax. This has the potential of reducing the taxpayer’s self-employment tax.

Considerations for Expatriates

Expatriates who own or plan to start non-per se corporations outside the U.S. should review how “check-the-box” election of foreign eligible entity may impact their overall tax liabilities in light of the tax plan. Where capital is a material income producing factor of the trade or business, expatriates should also note that there would be no change to the allowance of up to 30% in net profits that may be deemed compensation for the purpose of foreign earned income exclusion.

Enhancement of Standard Deduction and Repeal of Personal Exemptions:

Standard deduction would be increased to incorporate personal exemptions for the taxpayer and the taxpayer’s spouse. Personal exemptions for children and dependents would be consolidated into an expanded child tax credit and a new family tax credit. These “enhancements”, however, are not without potential downside; expatriates with qualifying children aged 17 or above, for whom personal exemptions would have been allowed under existing law, may find themselves losing the benefits of these exemptions.

Enhancement of Child Tax Credit and New Family Tax Credit:

Child tax credit would be increased by $600 to $1,600 per child. The initial limit of $1,000 for refundable credit per child would be indexed to chained CPI and, over time, rise to match (but not exceed) the $1,600 base child tax credit. In addition, a non-refundable family tax credit of $300, which is scheduled to sunset after 2022, would be provided for the taxpayer, the spouse in the case of a joint return, and each dependent who is not qualifying child. These credits are subject to phaseout based on modified adjusted gross income, the thresholds of which would be adjusted to eliminate marriage penalty and increased to allow more families to benefit from these credits –

The increases in child tax credit and thresholds for phaseout are, indeed, welcome news as more expatriates should be able to benefit from the credit. For those whose dependents are not qualifying children, however, the new family tax credit of $300 per person might not quite make up for the loss of personal exemption(s), even at 25% (above which the credit would be fully phased out for an average family).

Simplification and Reform of Deductions:

Many of the familiar deductions would be repealed. It is anticipated that these changes would result in fewer than 10% of the taxpayers choosing to itemize their deductions, compared to about 33% today –

- Deductions for Adjusted Gross Income (Above-the-line deductions)

- Alimony payments

- Moving expenses

- Medical savings account

- Itemized Deductions

- Medical expenses

- State and local income taxes or sales taxes

- Taxes not paid or accrued in a trade or business

- Tax preparation expenses

- Employee business expenses

- Personal casualty losses (except for losses associated with special disaster relief legislation)

(A) Alimony Payments

Alimony payments would not be deductible by the payor. By the same token, neither would alimony payments be includible in the income of the payee. These changes would apply to –

- Divorce decrees or separation agreements executed after 2017; and

- Any such instrument executed before 2018 and modified after 2017, if expressly provided for by such modification(s).

Under existing law, alimony payments includible in the recipient’s gross income are deemed “compensation” for the purpose of IRA contributions. Expatriates planning to contribute to IRA with alimony payments should note that such treatment would no longer apply, with the update of code sections related to alimony payments, and consider other options in the event their divorce decrees or separation agreements are affected by this provision.

(B) Moving Expenses

Under current law, taxpayers may claim a deduction for certain moving expenses paid or incurred in connection with the commencement of work as an employee or as a self-employed individual at a new principal place of work, provided certain conditions are met. In addition, expatriates relocating to a foreign country may claim a deduction for reasonable expenses related to storage during their employment overseas. Deductions for these qualified moving expenses are allowable whether or not the taxpayer itemizes his or her deductions. Similarly, payments of or reimbursements for such qualified moving expenses by an employer are excluded from the employee’s income. Beginning 2018, qualified moving expenses would neither be deductible nor excludable from taxable compensation.

Expatriates who plan to relocate for employment/assignment overseas or are in the process of negotiating the terms of their relocation/assignment should consider the tax implications of these changes.

(C) Mortgage Interest

Indebtedness Incurred After November 2, 2017

There would be a number of changes to the deduction of mortgage interest –

- Limit for acquisition indebtedness (for acquiring, constructing, or substantially improving a residence) will be reduced to $500,000 ($250,000 for MFS), compared to $1,000,000 ($500,000 for MFS) under current law;

- Interest would be deductible only on a taxpayer’s principal residence;

- Interest on refinancing secured by the principal residence would be deductible but only to the extent the amount of the indebtedness resulting from such refinancing does not exceed the amount of the refinanced indebtedness; and

- Interest on vacation home and home equity indebtedness would no longer be deductible.

Grandfathered Indebtedness Incurred On or Before November 2, 2017

- Refinanced debt generally would be treated as incurred on the same date that the original debt was incurred for purposes of determining the limitation amount applicable to the refinanced debt.

Exception for Written Binding Contract Entered Into Before November 2, 2017

The related indebtedness would be treated as being incurred prior to November 2, 2017 if the following conditions are met –

- Such binding contract is for closing the purchase of a principal residence before January 1, 2018; and

- Purchase of such residence must take place before April 1, 2018

Considerations for Expatriates

Expatriates who have entered into a binding contract before November 2, 2017 to close on the purchase of a principal residence by December 31, 2017 should ensure the purchase does take place no later than March 31, 2018 in order for the exception to apply. Expatriates planning to purchase a home, especially in locations known for high housing prices, such as Hong Kong, Singapore, and London, would likely see the deduction of their mortgage interest limited and their ability to itemize deductions hampered, depending on the structure of the loan and rate of interest.

(D) State and Local Taxes

Deductions for state and local real property taxes would still be allowed but limited to $10,000 ($5,000 for MFS). State and local income or sales taxes as well as personal property taxes, on the other hand, would no longer be deductible, unless paid or accrued in carrying on a trade or business or for the producing income.

It appears that foreign real property taxes would not be deductible, unless paid or accrued in carrying on a trade or business or for the production of income; if this is confirmed, expatriates who purchased personal residence overseas would lose the ability to deduct foreign real property taxes they pay on these properties. On the other hand, language of the tax bill does not seem to exclude the deduction of foreign income tax, which may be taken in lieu of foreign tax credit.

Simplification and Reform of Exclusions and Taxable Compensation:

(A) Limitation on Exclusion for Employer-Provided Housing

The exclusion for housing provided for the convenience of the employer and for employees of educational institutions would be limited to $50,000 ($25,000 for MFS). Such exclusion, when provided to “highly compensated employees” (with compensation in excess of $120,000 for 2018, as adjusted for inflation), would also be subject to phaseout.

The tax bill does not contain language about how any such housing costs in excess of the exclusion limits may or may not be eligible for foreign housing exclusion. One possibility would be to take into account the difference between the exclusion limits under this provision and the geographical limits updated by the IRS annually for foreign housing exclusion. Expatriates living in employer-provided camp housing, which is a common arrangement in countries such as Saudi Arabia, should continue to monitor the development. Even if the cost of camp housing becomes eligible for foreign housing exclusion, expatriates, whose compensation exceeds the limit for foreign earned income exclusion, may incur a higher tax liability than under current law because the base housing amount ($16,656 for 2018) is not excludable and as a result of the stacking rule, which may put them in a higher tax bracket.

(B) Exclusion of Gain from Sale of a Principal Residence

Taxpayers intending to take advantage of the exclusion of gains from the sale of their principal residence would be required to meet more stringent requirements –

- The ownership and use requirements would be lengthened to 5 out of 8 years (compared to 2 out of 5 years under current law);

- The exclusion may only be used once every 5 years (compared to 2 years under current law);

- Excludable gains up to the limit of $250,000 ($500,000 for MFJ) would be reduced, but not below zero, by the excess of (a) the taxpayer’s average modified adjusted gross income for 3 year over (b) $250,000 ($500,000 for MFJ);

- The maximum period of temporary absence, due to change of employment, health conditions, or such other unforeseen circumstances, that may be excluded from the period of nonqualified use would remain 2 years; and

- The denominator for the ratio used to determine the reduced exclusion available to taxpayers who fail to meet the requirements above, where such sale or exchange is by reason of a change in place of employment, health, or unforeseen circumstances would be increased to 5 years in conjunction with the other changes.

Expatriates who have not used their homes in the U.S. for some years due to their assignment/employment overseas and were relying on the 2 out of 5 year rule under current law to maximize their excludable gain may now need to reconsider their plan in the event this provision is enacted. High-income expatriates with impending transactions in which substantial income would be recognized (e.g. stock option exercise, bonus payment, sell of stocks, etc.) should also consider the timing of such transactions relative to the closing of their home sale.

Simplification and Reform of Education Incentives:

The Lifetime Learning Credit (LLC) will be consolidated into an enhanced American Opportunity Tax Credit (AOTC). Unlike LLC under current law, however, the enhanced AOTC may only be claimed for the first 5 years of post-secondary education at an eligible educational institution and the credit for the fifth year would only be at half the rate (as the first four years), with up to $500 of such credit being refundable.

Consolidation of Education Savings Rules:

No new contributions to Coverdell education savings accounts would be allowed after 2017 (except rollover contributions) but tax-free rollovers from Coverdell accounts into section 529 plans would be allowed. On the other hand, elementary and high school expenses of up to $10,000 per year would be considered qualified expenses for section 529 plans. Qualified expenses would also be expanded to cover expenses associated with apprenticeship programs.

Repeal of Other Provisions Related to Education:

The following deductions and exclusions related to education would be repealed –

- Student loan interest deduction

- Tuition and fees deduction

- U.S. savings bond interest exclusion

- Exclusion for qualified tuition reduction programs

- Exclusion for employer-provided education assistance programs

Estate, Gift, and Generation-Skipping Transfer Taxes:

The estate and generation-skipping taxes would be repealed for estates of decedents dying after 2023. Beneficiaries would, however, still receive a stepped-up basis in estate property inherited.

The estate tax basic exclusion amount would be doubled from $5 million (as of 2011) to $10 million and indexed for inflation, effective for tax years beginning after 2017.

The top rate of gift tax for gifts made after 2023 would be lowered to 35%. The basic exclusion amount of $10 million and annual exclusion of $15,000 (as of 2018) would be indexed for inflation.

Expatriates who are not U.S. citizens and those with non-U.S. citizen spouses, nevertheless, would see no additional reprieve.

American Expatriate Tax is a part of Contexo Global Mobility Solutions & Tax Consulting Ltd. registered in Hong Kong. Together, we help companies and individuals navigate through the complexities of global mobility and related tax issues. Here is where you will find a blend of expertise from Big 4 accounting firms and Fortune Global 500 companies but the attention of a boutique consulting practice. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.